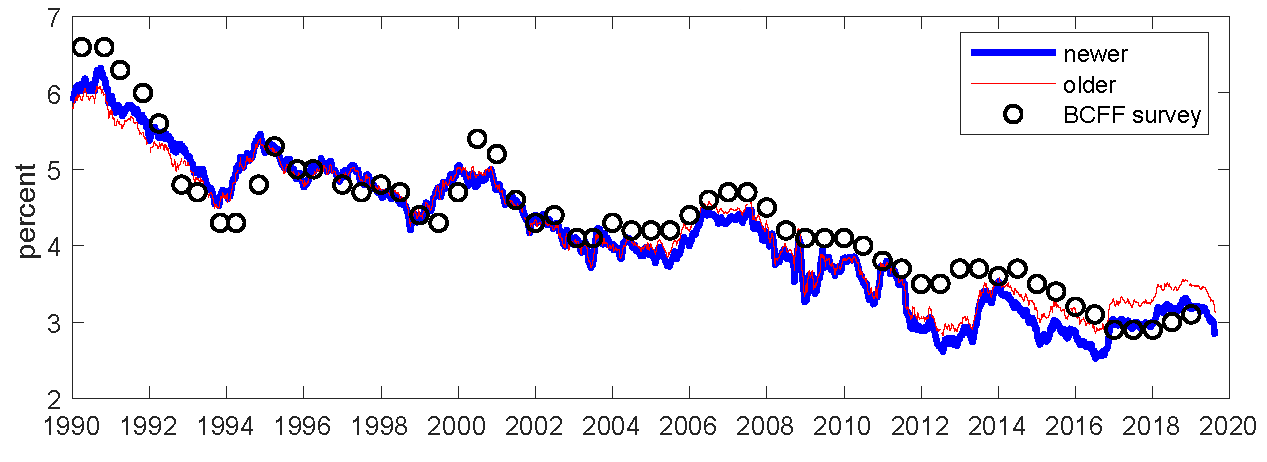

hullwhite - Hull white model Monte Carlo simulation Zero Coupon Bond - Quantitative Finance Stack Exchange

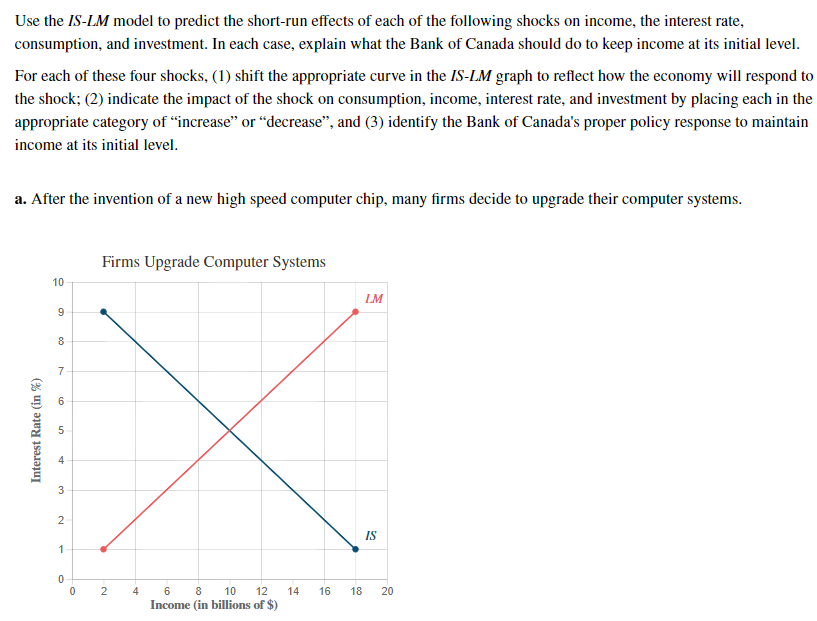

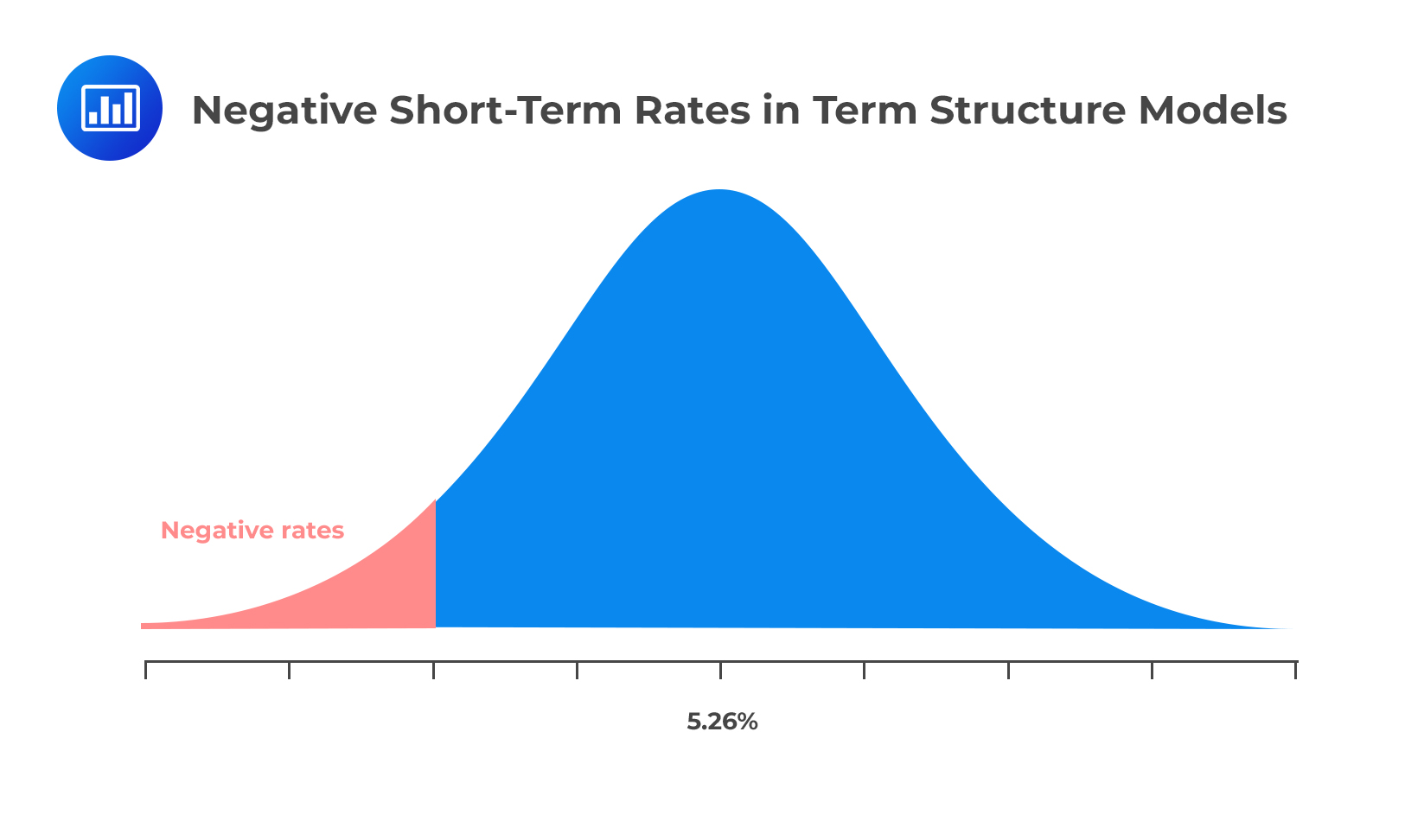

Using the IS-LM model, graphically illustrate and explain what effects a reduction in money growth will have on output, the nominal interest rate, and the real interest rate in the short run.

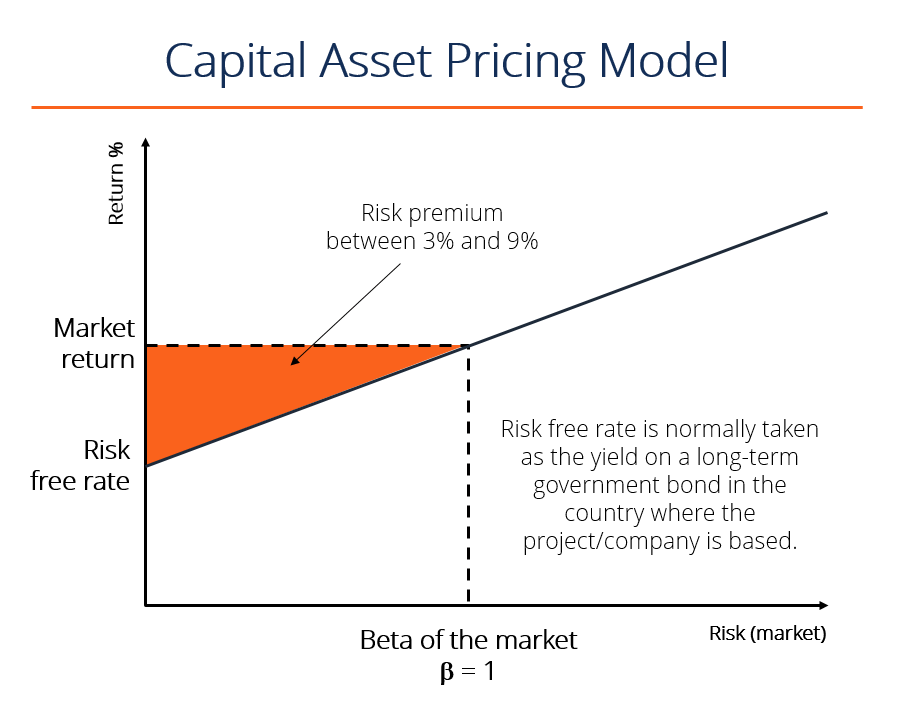

:max_bytes(150000):strip_icc()/Term-Definitions_capm_FINAL-f0f4b778e9d34c3296999cc8a8690ca7.png)

:max_bytes(150000):strip_icc()/Black-Scholes-Model-FINAL-1-18b2378c6f894a15b5904289870aa532.jpg)

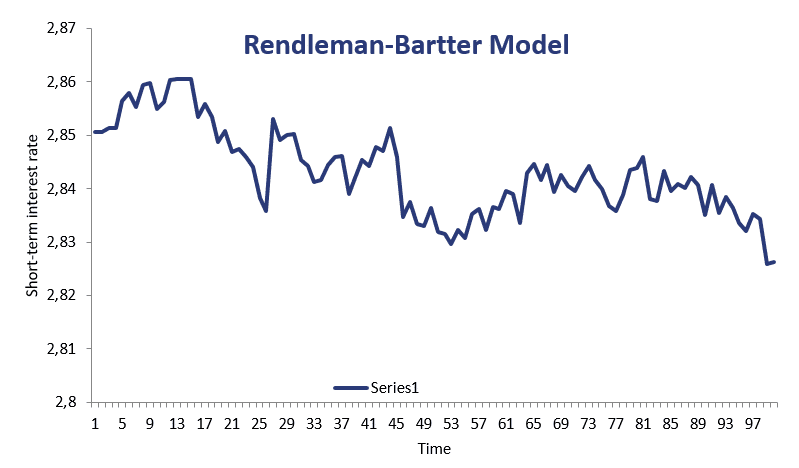

![PDF] COMPARISON OF ALTERNATIVE MODELS OF THE SHORT-TERM INTEREST RATE | Semantic Scholar PDF] COMPARISON OF ALTERNATIVE MODELS OF THE SHORT-TERM INTEREST RATE | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/51c105847b0a4d62c680cad9609e04819c4a90d9/28-Table1-1.png)